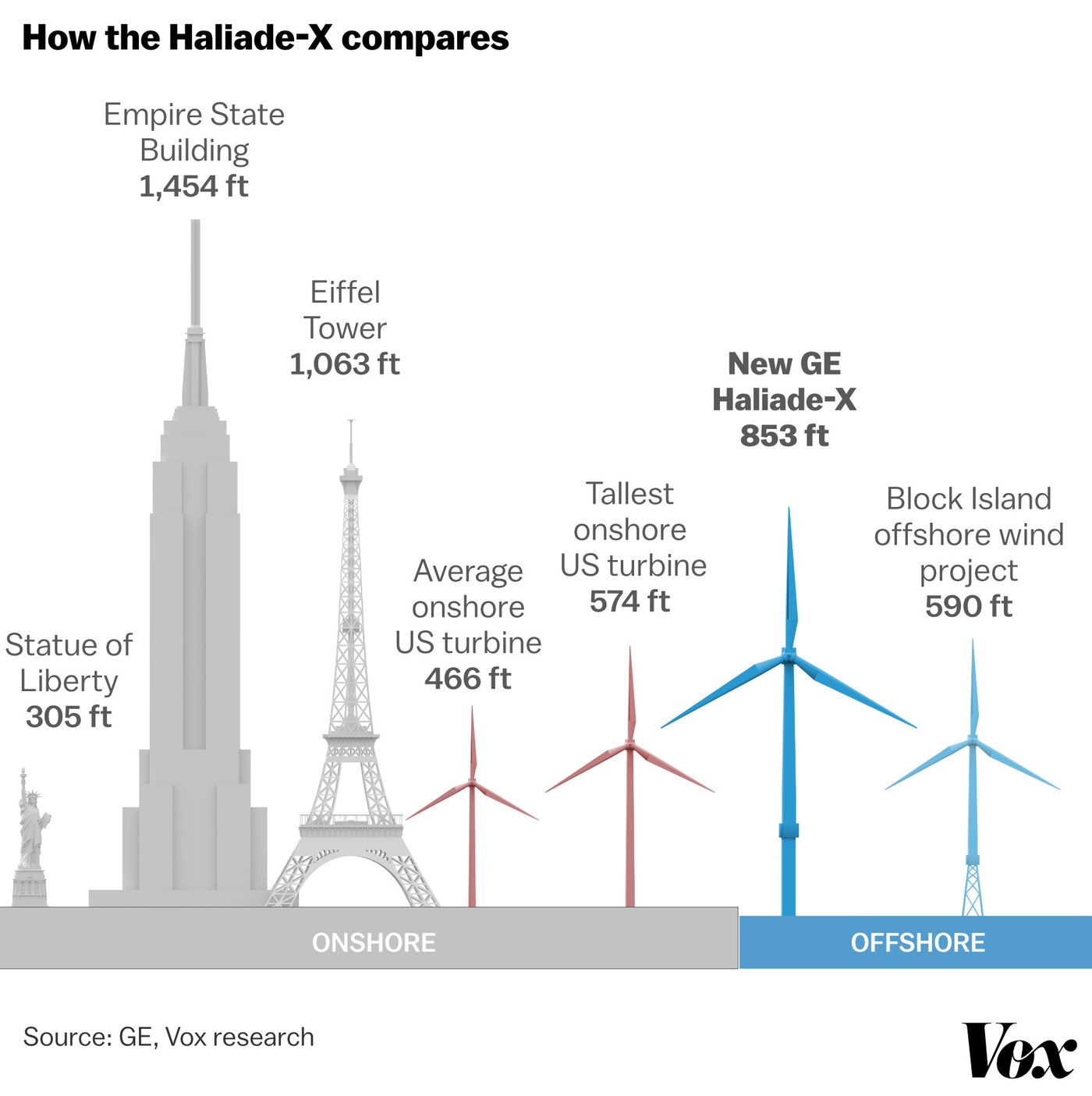

I think that supposes subsidizing the wind farms by somebody other than the rate payers, I think. I could be mistaken, of course.

Up through 2025 there is still a 30%

Federal investment tax credit for

offshore wind, which may or may not be going away thereafter. I don't believe any of the current offshore wind developers in MA have opted for production credits as the alternative.

The legislatively mandated offshore wind procurements in MA specify a minimum total capacity, and there will be a guaranteed minimum price/MWh up to contract production levels, all determined by an open bidding process.

More discussion of the bid & price structures can be found here. There will be more, since that was just the first of three tranches. There is no subsidy- it's all built onto contract price, and the large utility buyers of those contracts are allowed to pass on those costs to the ratepayers. But every time new bids are opened up, they come in substantially cheaper than projected when the MA offshore wind mandates went into effect. The party is still getting started, but there really isn't any stopping it at this point.

What doesn't show up in the contract price is the effect on spot-market localized marginal price (LMP) and day-ahead electricity price markets. As a zero marginal cost supplier the wind operator can put in $0 bids into spot markets and move to the head of the dispatch queue, accepting whatever price gets set by the next-most-expensive supplier. During times of high demand

extreme spot market pricing is common, but when there are $0 bidders of any significant capacity those numbers are VERY well damped, making it harder for low capacity factor #2 jet peakers or single cycle gas peakers to break even, since their capacity factors get smaller whenever there is $0 marginal cost goods active on the grid (whether solar or wind.)

In New England the highest wholesale electricity prices usually happen during air conditioning peaks, but there are also times when a Polar Vortex disturbance cold snap puts enough space heating load on the regional gas grid that supplies to combined cycle gas plants have to be curtailed, sending electricity market prices into the stratosphere for days, and all the oil fired plants are running flat-out getting fat. The heavy cost to utilities of the extreme winter peaks are a serious driver of retail rates, which in MA get adjusted twice per year. A meteorlogically statistical fact of New England life is that average offshore wind speeds pick up substantially cold snaps, particularly during the first half of cold snaps, which will inevitably cut those extreme price peaks off at the knees due to the excess zero margin capacity. This would be the New England version of how even combined cycle gas plants in Texas can become uneconomic in the presence of large scale wind development (despite the radically different market structures in ISO-NE vs. the freewheeling ERCOT.)

Another factor entering the local electricity markets now and on to 2030 are the electricity storage mandates, which will be able to under-price most grid services such as voltage & frequency stabilization by a substantial amount, services previously served by peakers. That party too is just getting started.

Of course the pipeline developers were all for installing higher capacity gas infrastructure to get around the weather induced price-peakiness, and were lobbying hard to push their costs (and risks) onto the electricity ratepayers. A substantial amount of analysis contracted for by the MA Attorney General's offices showed that in the early years that was likely to lower retail electricity prices slightly, but would inevitably lead to much higher prices later sticking the electric ratepayers with a stranded asset (due to already legislated carbon emissions limits) well before the pipeline was paid off. It's widely speculated that the real driver for the enhanced pipeline were those looking to develop an LNG export capacity in Maine or Nova Scotia, which would have increased the price of gas to New England ratepayers (both gas & electric). Saddling the electric ratepayers for the risk and delivering the LNG export profits to the pipeline developers & gas producers is a great deal for the investors- can't blame them for trying. But the Attorney General's report pretty much took a sledge hammer to their dreams.

The cost of wind & solar & battery storage are continuing to decline on fairly aggressive learning curves. Economist Tony Seba's new think tank "

ReThink-X" ran the weather data and conservatively projected numbers for the ISO-NE , CAISO, and ERCOT regions and determined that even without building out more grid infrastructure OVERBUILDING solar + wind + battery storage would be sufficient to provide reliable 24/365 power to each of those grids, and that the sweet-spot mixes for each region using just those three technologies would be even cheaper than keeping the existing power generators running. Whether/when that happens or not is a choice only somewhat steerable by policy makers. The raw economics of it are compelling- one way or the other dirt-cheap electricity is coming in most of our lifetimes, with or without tax credits or other subsidies. Just as the large telephone companies passed on running the internet back in 1980 (who would ever use that stuff?) and dismissed cellular telephones as too tiny to be bother with in 1990, most of the utilities and oil/gas industry insiders right now have barely an inkling just how badly they will be clobbered by the tsunami of ubiquitous & cheap renewables & storage by 2030.

In a similar and related disruption, US auto makers (other than Tesla) have been caught short, and have very little hopes of competing with the Chinese electric vehicle vendors. The recently released X-Peng P5 is something of a Toyota-Camry sized luxury car priced under $25KUSD (without subsidy). BYD's EA-1 (aka "Dolphin") released this year is roughly like Honda Fit or Toyota Corolla in size & appointments, starting at under $15KUSD for the smaller battery model (which is still good for north of 170 miles on single charge the bigger battery versions can go more than 400 miles)). BYD is a vertically integrated company- they make their own batteries (and are the 4th largest battery maker in the world), and even their own chips. Their lithium iron phosphate batteries are the safest on the market (it's hard to set them on fire), and their battery cost is substantially lower than Tesla's.

Speaking of Tesla- their Shanghai factory is delivering more cars than their flagship factory in Fremont CA, and they are current in the process of doubling it's size, expecting to be on line before the end of 2022. Up until recently many/most of the Shanghai Teslas were being exported, but that has changed over the past quarter, and in September fewer than 5000 of the ~56000 cars produced stayed in China(!). At the same time, the Tesla Model 3 outsold all German internal combustion cars of similar size & luxury

in Germany last month! The European car makers are mostly in the same boat as the US (maybe half a paddle-stroke ahead), but the head of VW commented the other day that it takes Tesla 8 hours to make a Model 3 compared to 30 hours for VW's ID-3 or ID-4 EVs. And this comes even before Tesla's giga-factory Berlin is up and running, selling mostly imported (from China) Model-3s. The gross margin on the Shanghai Model 3s is something like 29-30% (

way better margins than any European or US produced car of any type), and the quality is

better than the Fremont CA produced Model-3s. It's really going to be hard for the European incumbents to compete in that segment of the market (but BYD & X-Peng probably can.)

GM is pretty much screwed on getting EV traction in the US after the Chevy Bolt battery fires fiasco. In China they have partnered with WuLing to make the Mini, a diminutive but sturdy ~$5000 USD (yes, the decimal point is in the right place) electric car currently a hot seller in China, coming to Europe in 2022 (?), but that's a far cry from the money they are accustomed to making on pickups and SUVS. Unless they can come up with a pickup EV more compelling than Ford's F150 EV, (let alone a Rivian or Tesla Cybertruck) before 2024 they may go bust by 2030. The demand is there- the Cadillac Lyriq electric SUV pre-orders sold out in under a half hour, but deliveries are still many months out, with no promises or ability to meet the (apparent) high demand. (Can they even get enough batteries delivered in time to meet their paltry Lyriq production schedule?) Ford isn't in particularly better shape. They say they are going to build a large EV & battery plant in TN, but they are even right now carrying a lot of debt on BB grade bonds (one step above junk bond status), and it's not clear where they'll be getting enough capital to pull that off.

OK, that's enough mega-slackin' for me today- time to go serve the paying customers.