Tom Sawyer

In the Trades

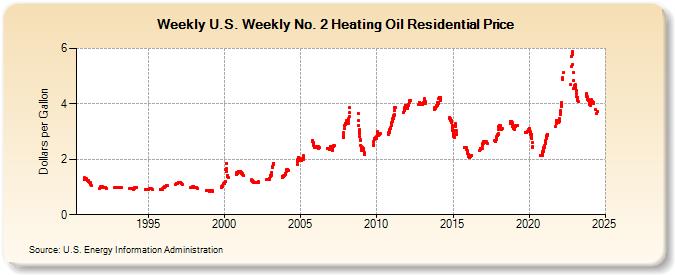

Pipeline bottlenecks that drove up natural gas home heating prices in New England last winter could cause trouble when the weather again turns cold, but oil prices that once climbed to record territory continue to fall.

That unusual sequence of events - higher prices for natural gas prices, which is promoted for its cost advantage relative to oil that's falling in price - was detailed by the U.S. Department of Energy's recent annual outlook. The wild card is the weather and how cold this winter will be.

Utilities began buying gas in April for the approaching heating season and prices in 2014 have averaged higher than last year, the U.S. Department of Energy said in its recent annual outlook. If temperatures plunge, federal officials project consumption will be down 3 percent while spending will rise by 6 percent over last year.

In contrast, weakening international demand helped North Sea Brent crude oil spot prices fall to an average of $97 per barrel in September, the first month Brent prices have averaged below $100 a barrel in more than two years. U.S. production also is at the highest level in nearly 30 years, federal energy officials say.

That's good news in the Northeast, where 23 percent of households depend on oil for heat. In the rest of the country, 5 percent of households use heating oil, the Energy Department said.

The agency's report relies on winter forecasts that will be warmer than last year, giving consumers of all sources of energy a break.

Nationally, projected average household spending for heating oil is 15 percent lower and reduced heating demand and higher prices contribute to natural gas spending that's also projected to be down, but by only 5 percent from last winter. Natural gas is still the cheapest heating source.

Declining oil prices are vindication to New England oil dealers who are fighting state officials seeking to expand natural gas pipeline systems when oil prices spiked several years ago. Oil dealers have insisted that higher oil prices in previous years were a natural response to market changes, and will decline in response to shifting supply and demand.

"It's 'I told you so,'" said Chris Herb, president of the Connecticut Energy Marketers Association, which represents oil dealers and sued state officials Friday, accusing them of violating state environmental laws to push through a plan favoring natural gas. "Government is horrible in predicting outcomes."

Jamie Py, president of the Maine Energy Marketers Association, which represents heating oil and other dealers, said oil prices have become more sensitive to rising and falling world demand than the frequent and destabilizing cycles of violence in the Middle East.

"There was a time when someone sneezed the wrong way in the Middle East you could see a spike," he said.

Chris Recchia, commissioner of the Vermont Public Service Department, said the benefits of natural gas over oil, such as the production of less carbon dioxide, make it a preferable source of energy. And the narrowing price gap "won't be there for long," he said.

New England states are seeking to rely more on natural gas, which in the past has been cheaper than oil. Toward that limited goal, the plan is working: Natural gas powered 45 percent of electricity generated in New England last year, down slightly from 52 percent in 2012, but up significantly from less than 30 percent in 2001, according to the Department of Energy.

But pipelines can't catch up with the greater supply, with power plants forced last winter to buy on the costly spot market that pushed up natural gas prices for consumers. It's not likely to change.

"Pipeline constraints still exist in the area and day-to-day price volatility is likely," the Energy Department said.

Although several pipeline construction plans are in various stages of development and planning, consumers shouldn't expect prices to fall soon because of the time needed to build pipelines. Prices are not expected to budge until 2017, Cunningham said.

"The question is, what do we do now?" he said.

More extensive storage of natural gas to ensure deliveries during periods of extreme cold would help utilities avoid high prices for emergency supplies, Cunningham said. A few dozen very cold days each winter put the biggest strain on supplies, he said.

"It's those 40-odd days that kill," he said.

Connecticut's largest utility, Connecticut Light & Power, plans for colder-than-normal temperatures by staggering purchases to include the off-season when the cost is lower, spokesman Mitch Gross said. It also stores reserves in a liquefied natural gas facility.

But Cunningham says the outlook for lower prices due to less severe weather is "something of a feel-good story."

"It's at least a prediction for some degree of relief," he said.

That unusual sequence of events - higher prices for natural gas prices, which is promoted for its cost advantage relative to oil that's falling in price - was detailed by the U.S. Department of Energy's recent annual outlook. The wild card is the weather and how cold this winter will be.

Utilities began buying gas in April for the approaching heating season and prices in 2014 have averaged higher than last year, the U.S. Department of Energy said in its recent annual outlook. If temperatures plunge, federal officials project consumption will be down 3 percent while spending will rise by 6 percent over last year.

In contrast, weakening international demand helped North Sea Brent crude oil spot prices fall to an average of $97 per barrel in September, the first month Brent prices have averaged below $100 a barrel in more than two years. U.S. production also is at the highest level in nearly 30 years, federal energy officials say.

That's good news in the Northeast, where 23 percent of households depend on oil for heat. In the rest of the country, 5 percent of households use heating oil, the Energy Department said.

The agency's report relies on winter forecasts that will be warmer than last year, giving consumers of all sources of energy a break.

Nationally, projected average household spending for heating oil is 15 percent lower and reduced heating demand and higher prices contribute to natural gas spending that's also projected to be down, but by only 5 percent from last winter. Natural gas is still the cheapest heating source.

Declining oil prices are vindication to New England oil dealers who are fighting state officials seeking to expand natural gas pipeline systems when oil prices spiked several years ago. Oil dealers have insisted that higher oil prices in previous years were a natural response to market changes, and will decline in response to shifting supply and demand.

"It's 'I told you so,'" said Chris Herb, president of the Connecticut Energy Marketers Association, which represents oil dealers and sued state officials Friday, accusing them of violating state environmental laws to push through a plan favoring natural gas. "Government is horrible in predicting outcomes."

Jamie Py, president of the Maine Energy Marketers Association, which represents heating oil and other dealers, said oil prices have become more sensitive to rising and falling world demand than the frequent and destabilizing cycles of violence in the Middle East.

"There was a time when someone sneezed the wrong way in the Middle East you could see a spike," he said.

Chris Recchia, commissioner of the Vermont Public Service Department, said the benefits of natural gas over oil, such as the production of less carbon dioxide, make it a preferable source of energy. And the narrowing price gap "won't be there for long," he said.

New England states are seeking to rely more on natural gas, which in the past has been cheaper than oil. Toward that limited goal, the plan is working: Natural gas powered 45 percent of electricity generated in New England last year, down slightly from 52 percent in 2012, but up significantly from less than 30 percent in 2001, according to the Department of Energy.

But pipelines can't catch up with the greater supply, with power plants forced last winter to buy on the costly spot market that pushed up natural gas prices for consumers. It's not likely to change.

"Pipeline constraints still exist in the area and day-to-day price volatility is likely," the Energy Department said.

Although several pipeline construction plans are in various stages of development and planning, consumers shouldn't expect prices to fall soon because of the time needed to build pipelines. Prices are not expected to budge until 2017, Cunningham said.

"The question is, what do we do now?" he said.

More extensive storage of natural gas to ensure deliveries during periods of extreme cold would help utilities avoid high prices for emergency supplies, Cunningham said. A few dozen very cold days each winter put the biggest strain on supplies, he said.

"It's those 40-odd days that kill," he said.

Connecticut's largest utility, Connecticut Light & Power, plans for colder-than-normal temperatures by staggering purchases to include the off-season when the cost is lower, spokesman Mitch Gross said. It also stores reserves in a liquefied natural gas facility.

But Cunningham says the outlook for lower prices due to less severe weather is "something of a feel-good story."

"It's at least a prediction for some degree of relief," he said.